Buying your first home in Manteca doesn't have to mean emptying your savings account for a down payment. Several zero-down loan programs are specifically designed to help first-time buyers achieve homeownership without the traditional 10-20% down payment barrier. Here's your complete guide to qualifying for these valuable programs in the Central Valley.

Whatever your reason, this guide will break down whether it’s smart or risky to buy a home in Manteca, California with zero down, and what steps to take if you choose this program. With insights from local mortgage expert Efren Sanchez at Optimal Loans, you’ll learn how to protect your investment, avoid common mistakes, and still make a confident home purchase.

Understanding Zero-Down Payment Loans

Zero-down payment loans allow qualified buyers to purchase a home without making an upfront down payment. While you'll still need funds for closing costs, inspections, and moving expenses, eliminating the down payment requirement can make homeownership accessible much sooner than traditional financing.

Top Zero-Down Loan Programs for Manteca Buyers

VA Loans: For Military Families

If you're a veteran, active-duty service member, or eligible spouse, VA loans offer one of the best zero-down options available. These government-backed loans feature no down payment requirement, no private mortgage insurance (PMI), and competitive interest rates.

VA Loan Benefits:

- 100% financing available

- No monthly mortgage insurance

- Flexible credit requirements

- Can be used multiple times

- Assumable by qualified buyers

USDA Rural Development Loans

Despite Manteca's growing suburban character, many areas still qualify for USDA Rural Development loans. These loans are designed for moderate-income buyers purchasing homes in eligible rural and suburban areas.

USDA Loan Requirements:

- Property must be in a USDA-eligible area (check the USDA map for specific Manteca neighborhoods)

- Income limits apply (typically 115% of median area income)

- Primary residence only

- Decent credit score (usually 640+)

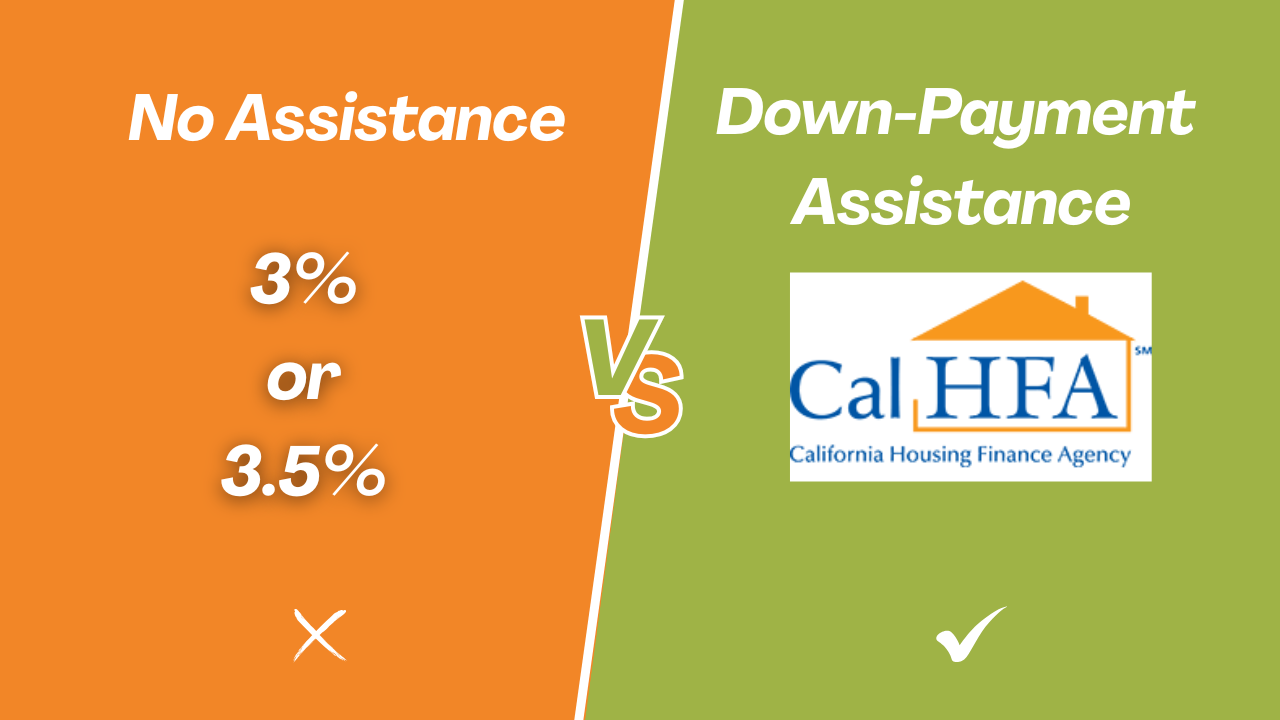

CalHFA and Local First-Time Buyer Programs

California Housing Finance Agency (CalHFA) offers several programs that can effectively create zero-down scenarios through down payment assistance grants and loans.

Popular CalHFA Programs:

- MyHome Assistance Program: Up to 3.5% of loan amount or $10,000 for down payment assistance

- Zero Interest Program (ZIP): Deferred payment junior loan for down payment assistance

- CalPLUS Conventional: Low down payment options with assistance programs

Qualifying Requirements You'll Need to Meet

Credit Score Standards

Most zero-down programs require a minimum credit score between 580-640, though some programs may accept lower scores with compensating factors. Focus on improving your credit score before applying by paying down existing debts and ensuring all payments are current.

Income and Employment Verification

Lenders will verify your employment history (typically 2 years) and ensure your debt-to-income ratio meets program guidelines. Most programs require your total monthly debt payments to be no more than 43-45% of your gross monthly income.

First-Time Buyer Definition

Most programs define "first-time buyer" as someone who hasn't owned a home in the past 3 years. Some programs extend this to 5 years or have different definitions, so you may qualify even if you've owned a home before.

Property Requirements

The home must be your primary residence, meet certain condition standards, and fall within program price limits. In San Joaquin County, conforming loan limits for 2024 are $766,550 for single-family homes.

Steps to Get Started in Manteca

1. Get Pre-Qualified

Start by speaking with a qualified loan officer who understands zero-down programs. They'll help you determine which programs you're eligible for and provide a pre-qualification letter for house hunting.

2. Complete Homebuyer Education

Many programs require completion of a HUD-approved homebuyer education course. These courses cover budgeting, the home buying process, and maintaining homeownership.

3. Shop Smart in Manteca's Market

Focus your search on properties that meet your chosen program's requirements. Consider established neighborhoods like Woodward Park, Raymus Village, or newer developments that may qualify for various programs.

4. Work with Experienced Professionals

Partner with a real estate agent familiar with zero-down programs and a lender who regularly processes these loan types. Their expertise can make the difference in successfully closing your loan.

Additional Costs to Budget For

While you won't need a down payment, you'll still need funds for:

- Closing costs (typically 2-3% of loan amount, though some can be financed or covered by seller concessions)

- Home inspection ($400-600)

- Appraisal (often paid by you the buyer)

- Moving expenses

- Initial homeowners insurance and property taxes

- Emergency fund for home maintenance

Common Mistakes to Avoid

Don't drain all your savings. Even with zero down, maintain an emergency fund for unexpected homeownership expenses.

Don't ignore your debt-to-income ratio. Just because you qualify doesn't mean you should borrow the maximum amount.

Don't skip the home inspection. Protecting your investment is crucial, especially when you're not putting money down upfront.

Making Your Manteca Homeownership Dream Reality

Zero-down loans open the door to homeownership for many first-time buyers in Manteca who previously thought they needed years to save for a down payment. With proper planning, good credit management, and the right loan program, you could be holding keys to your new home sooner than you think.

The key is starting the process early, understanding your options, and working with experienced professionals who can guide you through the specific requirements of each program. Manteca's growing community, excellent schools, and proximity to both the Bay Area and Sacramento make it an ideal place to establish roots – and zero-down loans can help make that happen.

Ready to explore your zero-down loan options? Contact our experienced loan team today to discuss which programs might be the best fit for your situation and start your journey toward Manteca homeownership.

Yes, you can buy a home in Manteca, CA with zero down, but that doesn’t mean you should go through it.

With rising home prices, quick-moving deals, and complex contracts, the guidance you do choose matters even more.

A trusted, experienced mortgage expert like Efren Sanchez gives you the tools, clarity, and confidence to navigate the process even with zero to low down payment.