What are the Best Home Loan Programs in Tracy, CA for 2025?

Tracy, California homebuyers have access to an impressive array of financing options in 2025, with programs designed to make homeownership more accessible than ever. Whether you're a first-time buyer, veteran, or experienced homeowner, understanding your loan options can save you thousands of dollars and help you secure the home of your dreams in this thriving San Joaquin County city.

Current Mortgage Market in Tracy, CA

As of June 2025, mortgage rates in Tracy are hovering in the 6.5% to 7% range for 30-year fixed-rate loans, with rates showing signs of potential decline as Federal Reserve officials hint at future rate cuts. The conforming loan limit for Tracy in 2025 is $806,500 for single-family homes, while FHA loan limits are set at $656,650.

Top Home Loan Programs for Tracy Buyers

1. CalHFA Programs - California's Premier First-Time Buyer Programs

The California Housing Finance Agency (CalHFA) offers the most comprehensive suite of programs for Tracy homebuyers, including multiple loan products with competitive rates and down payment assistance.

CalHFA FHA Program: Features a 30-year fixed interest rate with FHA insurance, perfect for buyers with moderate credit scores and limited down payment funds.

CalPLUS Programs: These include both FHA and conventional options with slightly higher interest rates but combined with the CalHFA Zero Interest Program (ZIP) for closing costs or MyAccess for down payment assistance.

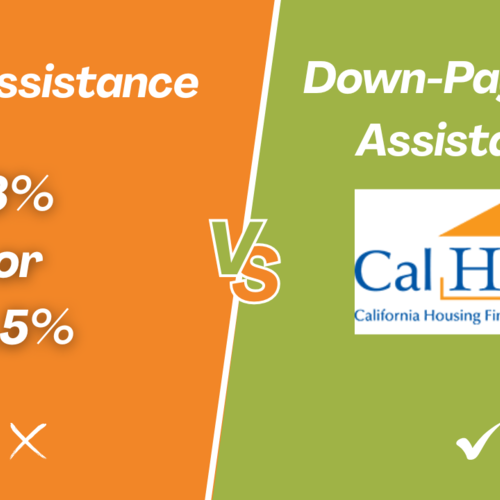

MyHome Assistance Program: Provides deferred-payment junior loans up to 3.5% of the purchase price for FHA loans or 3% for conventional loans to assist with down payment and closing costs. The best part? These are "silent seconds" with no monthly payments required until the home is sold, refinanced, or paid in full.

2. FHA Loans - Accessible Homeownership

FHA loans remain one of the most popular choices for Tracy buyers, offering down payments as low as 3.5% with fewer restrictions than conventional loans. In 2025, FHA loan limits in Tracy range from $656,650 for single-family homes up to $1,262,800 for four-unit properties.

Key FHA Benefits:

- Minimum down payment of 3.5%

- Credit scores as low as 580 accepted

- Seller can contribute up to 6% toward closing costs

- Assumable loans for future buyers

3. VA Loans - Unbeatable Benefits for Veterans

VA loans offer no down payment requirements and special terms for veterans and active-duty military personnel. The 2025 VA loan limit for Tracy is $806,500, matching the conforming loan limit.

VA Loan Advantages:

- Zero down payment required

- No private mortgage insurance

- Competitive interest rates

- Assumable by qualified buyers

- No prepayment penalties

4. Conventional Loans - Flexibility and Competitive Rates

For buyers with strong credit and stable income, conventional loans offer excellent terms. First-time buyers can secure conventional loans with down payments as low as 3%, and those putting down 20% or more avoid private mortgage insurance entirely.

5. USDA Rural Development Loans

While Tracy is primarily suburban, some areas may qualify for USDA loans, which offer zero down payment options for eligible rural and suburban locations.

Local Down Payment Assistance Programs

City of Tracy Down Payment Assistance Program

The City of Tracy offers deferred down payment assistance loans up to $40,000 (or 20% of the sales price, whichever is less) to low-income, first-time homebuyers purchasing homes within Tracy city limits. This program operates on a first-come, first-served basis and requires:

- Residency or employment in San Joaquin County for 12 months

- Completion of HUD-approved homebuyer education

- Minimum 1% cash down payment from borrower

- 30-year fixed-rate primary mortgage

San Joaquin County GAP Program

The San Joaquin County GAP Loan Program provides similar assistance up to $40,000 for purchases in unincorporated county areas or specific cities including Escalon and Lathrop.

Golden State Finance Authority (GSFA) Platinum Program

The GSFA Platinum Program offers down payment assistance up to 5% of the first mortgage loan amount, with 3.5% provided as a 15-year amortizing second mortgage and up to 1.5% potentially available as a gift that doesn't require repayment.

Specialized Programs for 2025

Dream For All Shared Appreciation Loan

California's newer Forgivable Equity Builder Loan provides up to 10% of the purchase price as a forgivable loan after five years, provided buyers continue living in the property full-time.

CalHFA ADU Grant Program

As part of the 2023-24 State Budget, $25 million has been allocated for ADU grants providing up to $40,000 for pre-development costs and closing costs to build accessory dwelling units.

Current Interest Rate Environment

Mortgage rates have remained relatively stable in 2025, staying within the 6.5% to 7% range for 30-year fixed-rate loans. Industry experts suggest that rates could start pushing lower as Federal Reserve board members hint at future rate cuts, with some officials suggesting cuts could happen as early as July 2025.

Credit and Income Requirements

Most programs require:

- Minimum credit score: 580-660 depending on the program

- Debt-to-income ratio: Generally below 50%

- Employment history: Two years of stable employment

- Homebuyer education: Required for most first-time buyer programs

Choosing the Right Lender in Tracy

When selecting a Tracy mortgage broker, look for someone the ability to provide various loan programs. Local lenders familiar with Tracy's market and California's specific programs can provide invaluable guidance.

Expert Local Guidance: For personalized assistance with Tracy home loans, consider working with experienced professionals like Efren Sanchez, loan officer, who specializes in helping Tracy area buyers navigate the complex landscape of California mortgage programs. Having a knowledgeable loan officer who understands both local market conditions and state-specific programs can make the difference between getting approved and getting the best possible terms.

Getting Started: Your Next Steps

- Assess your financial situation and determine your budget

- Check your credit score and address any issues

- Research programs that match your profile

- Complete homebuyer education if required

- Get pre-approved with multiple lenders to compare rates

- Work with a knowledgeable real estate agent familiar with Tracy

For expert guidance on Tracy home loan programs and to explore your financing options, visit optimalloans.com/efren-sanchez to connect with Efren Sanchez, a local loan officer specializing in California home financing programs.

Bottom Line

Tracy's 2025 home loan landscape offers unprecedented opportunities for buyers at all experience levels. With conforming loan limits reaching $806,500, multiple down payment assistance programs providing up to $40,000 in help, and competitive interest rates, the path to homeownership in Tracy has never been more accessible. The key is understanding which programs align with your financial situation and long-term goals.

Whether you're a first-time buyer taking advantage of CalHFA's comprehensive programs, a veteran leveraging VA loan benefits, or an experienced buyer seeking the best conventional loan terms, Tracy's diverse lending environment ensures there's a program designed for your success. Working with an experienced loan officer like Efren Sanchez can help you navigate these options and secure the best possible terms for your unique situation. Start by speaking with qualified lenders who understand both local programs and your unique needs to make 2025 the year you achieve homeownership in Tracy, California.

This guide provides general information about home loan programs available in Tracy, CA as of 2025. Loan terms, rates, and program availability may change. Always consult with qualified lenders and housing counselors for personalized advice based on your specific situation.